Key Inclusions

§ An executive summary of the insights captured during our research, offering a high-level view on the current state of lab automation market and its likely evolution in the mid-to-long term.

§ A general overview of lab automation, along with details on its historical evolution, different stages and processes. In addition, the chapter presents information on the advantages of lab automation and the challenges associated with its use. Further, it concludes with a discussion on the future perspectives in this domain.

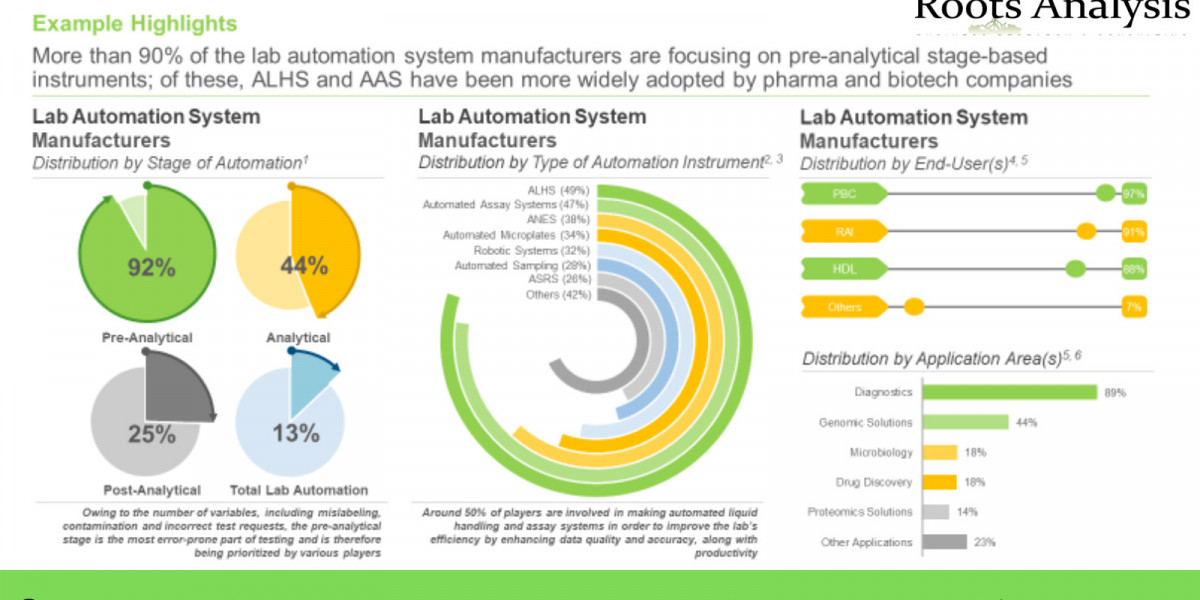

§ A detailed assessment of the overall market landscape of around 350 lab automation system manufacturers, based on several relevant parameters, such as year of establishment, company size (in terms of number of employees), location of headquarters, types of lab automation system(s) (automated liquid handling systems (automated integrated workstations, pipetting systems and reagent dispensers), automated microplate systems (automated microplate workstations, microplate washers, multi-mode microplate readers and single-mode microplate readers), automated assay systems, automated nucleic acid extraction systems, robotic systems, automated storage and retrieval systems (ASRS), automated sampling systems and other lab automation equipment), stage(s) of automation (pre-analytical stage, analytical stage, post-analytical stage and total lab automation), application area(s) (drug discovery, diagnostics, genomic solutions, proteomic solutions, microbiology and other applications) and end-user(s) (pharmaceutical and biotechnology companies, research and academic institutes, hospitals and diagnostic laboratories and other end-users).

§ A detailed competitiveness analysis of lab automation system manufacturers based on several relevant parameters, such as company strength (in terms of number of years since it was established), product diversity (in terms of number of lab automation system being developed by the company) and product strength (in terms of stage(s) of automation, application area(s) and end-user(s)).

§ Elaborate profiles of key players (shortlisted based on a proprietary criterion) engaged in the development of lab automation systems across North America, Europe and Asia-Pacific and Rest of the World. Each profile features a brief overview of the company, details related to its financial information (if available), product portfolio, recent developments and an informed future outlook.

§ A detailed analysis of partnerships inked between stakeholders engaged in this domain since 2018, based on several relevant parameters, such as year of partnership, type of partnership, type of partner, type of automation instrument(s), most active players (in terms of number of partnerships) and regional distribution of partnership activity in this domain.

§ An in-depth analysis of various patents that have been filed / granted related to lab automation since 2018, taking into consideration several relevant parameters, such as patent publication year, type of patent, patent jurisdiction, CPC symbols, type of applicant, emerging focus areas and leading players (in terms of number of patents filled / granted) and leading individual assignees. It also features a detailed patent benchmarking analysis and an insightful valuation analysis, highlighting the leading patents (in terms of number of citations).

§ Informed estimates of the existing market size and the future opportunity for lab automation instruments, over the next 12 years. Based on multiple parameters, such as global instrumentation market in life science industry, biopharmaceutical industry and share of automation, we have provided informed estimates on the evolution of the market for the period 2023-2035.

§ A case study on the lab automation software providers, providing detailed analysis on various parameters such as year of establishment, company size (in terms of number of employees), location of headquarters, type of software (laboratory information management system, laboratory information system, electronic lab notebook, scientific data management system and other software), mode(s) of deployment (cloud-based and on-premise), end-user(s) (pharmaceutical and biotechnology companies, research and academic institutes, and hospitals and diagnostic laboratories).

The report also features the likely distribution of the current and forecasted opportunity across important market segments, mentioned below:

§ Stage of Automation

§ Pre-Analytical

§ Analytical

§ Post-Analytical

§ Total Lab Automation

§ Type of Instrument

§ Automated Liquid Handling Systems

§ Automated Microplate Readers

§ Automated Sampling Systems

§ Analyzers

§ Automated Storage and Retrieval Systems (ASRS)

§ Other Instruments

§ End-User

§ Pharmaceutical and Biotechnology Companies

§ Research and Diagnostic Laboratories

§ Other End-Users

§ Key Geographical Regions

§ North America

§ Europe

§ Asia-Pacific

§ Middle East and North Africa

§ Latin America

Key Questions Answered

§ What is lab automation?

§ What is automated liquid handling system? What are examples of liquid handling systems?

§ How many players are currently involved in the development of lab automation systems?

§ Which are the top players in the lab automation market?

§ What is the global market size of the lab automation market?

§ What is the growth rate of lab automation market?

§ Which region is likely to hold the largest share in the lab automation market?

§ What is the market share of automated liquid handling systems?

§ What are the factors driving the lab automation market?

To view more details on this report, click on the link

https://www.rootsanalysis.com/reports/lab-automation-market.html

News article

Learn from experts: do you know about these emerging industry trends?

Cell Therapy – The Revolutionary Therapeutic Modality: All Set To Obliterate Oncological Disorders

T-cell Immunotherapies: The Future of Modern Cancer Treatments

Learn from our recently published whitepaper: -

Next Generation Biomanufacturing – The Upcoming Era of Digital Transformation

About Roots Analysis

Roots Analysis is a global leader in the pharma / biotech market research. Having worked with over 750 clients worldwide, including Fortune 500 companies, start-ups, academia, venture capitalists and strategic investors for more than a decade, we offer a highly analytical / data-driven perspective to a network of over 450,000 senior industry stakeholders looking for credible market insights.

Learn more about Roots Analysis consulting services:

Roots Analysis Consulting - the preferred research partner for global firms

Contact:

Ben Johnson

+1 (415) 800 3415